Home » Money Talk 101: Financial Literacy Mini-Crash course for beginners

Money Talk 101: Financial Literacy Mini-Crash course for beginners

KINDLY SHARE THIS POST

Let me make something extremely clear, as much as you love your offer, sell it and oversell it if you don’t understand how finances work, you are less likely to accumulate wealth in the long-run, I know that a little too well. As creators we tend to obsess over the work, the craft and we neglect an extremely important part of the business, how money flows in your business, if you ain’t got no cash flow, your business is on life support! Period! We need to make our money, keep that money and make more of that money overtime.

So today we are acquainting ourselves with financials terms so you don’t end up rolling your eyes at your accountant or worse yet panic when your bills are overdue. So understand money to make money! Look at this as a mini finance masterclass. As a beginner in the world of business, understanding financial terminologies is crucial for the success of your business; so I am going to do a quick run through of those terms. Understanding these financial terms is essential for anyone who wants to start a business, pitch to investors or even invest in the stock market. By familiarizing yourself with these concepts, you can make better financial decisions and avoid common pitfalls that can derail your business.

If it seems daunting at first, fret not! Take it one step at a time and correlate it to your current business model(s) and your accounting system. So as you are ready to navigate the world of both personal and business finance, here are some of the terms that will help you make informed decisions about your money and your time. Now get your notepad and pen, lets get started! We will discuss 45 concepts divided into 8 specific sections to help you categorize them as you run your finances.

1. FINANCIAL STATEMENTS:

- Balance Sheet: is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. This provides a snapshot of a company’s financial position, and is typically prepared at the end of each quarter or year.

- Income Statement: is a financial statement that shows a company’s revenue, expenses, and profit over a specific period of time. This is also known as a profit and loss statement, and is typically prepared on a quarterly or annual basis.

- Cash Flow Statement: A financial statement that tracks the cash inflows and outflows during a specific period. It shows the sources and uses of cash, including operating activities, investing activities, and financing activities.

2. FINANCIAL CONCEPTS:

- Asset: it is anything that a company own that has monetary value and can be used to produce future economic benefits. Examples of assets include cash, real estate, stocks, and investments. Assets are typically listed on a company’s balance sheet.

- Liability: it is a financial obligation that company owes to others, such as loans or debts. Liabilities are also listed on a company’s balance sheet.

- Equity: it refers to the portion of a company’s assets that belongs to its owners after deducting all liabilities.

- Income: it refers to the money received from various sources such as salary, investments, or business earnings.

- Expense: it is money spent to pay for business goods and services rendered. Examples of expenses include rent, groceries, and utility bills. Expenses are subtracted from revenue to calculate profit.

- Cash Flow: it is the amount of cash coming in and going out of a business finances over a given period. It’s important to monitor your cash flow to ensure that you have enough cash on hand to cover your expenses and invest in your future.

- Budget: it is a financial plan that outlines expected income and expenses over a specific period. A budget is a useful tool for managing your finances and ensuring that you are not overspending and misusing company’s assets.

- Profit: is the amount of money a company earns after subtracting its expenses from its revenue. This is also known as the bottom line, as it represents the final figure on a company’s income statement.

- Loss: is the negative difference between total revenue and total expenses. While losses are not desirable, they are a natural part of doing business and can be used as learning opportunities.

- Revenue: Revenue refers to the amount of money a company earns from the sale of its goods or services. This is the top line of a company’s income statement, which shows the total amount of money it has made during a particular period.

- Net Income: Net income is the profit a company earns after all expenses, including taxes, have been deducted. This is the most important number for investors, as it reflects a company’s profitability after all costs have been accounted for.

- Gross Income: is the total income earned by a company before any expenses have been deducted. This figure is often used to calculate gross profit margin, which is the percentage of revenue that remains after deducting the cost of goods sold.

3. FINANCIAL RATIOS & METRICS:

- Profit Margin: A measure of a company’s profitability, calculated as the ratio of net income to revenue. It indicates the percentage of revenue that becomes profit.

- Return on Investment (ROI): is a financial metric that calculates the return or profit generated relative to the cost of an investment. It is expressed as a percentage and helps assess the efficiency of an investment. Calculating it is important to evaluate the success of an investment and determine whether it’s worth continuing.

- EBITDA: Stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures a company’s operating performance by excluding non-operating expenses and non-cash items.

- Interest: is the cost of borrowing money, usually expressed as a percentage of the amount borrowed. Interest rates can have a significant impact on your finances, so it’s important to understand them when taking out loans with a bank or investing.

- Principal: is the original amount of money borrowed or invested. When repaying a loan or making an investment, the principal is the amount that you initially borrowed or invested.

- Accounts Payable: The amount of money a company owes to its suppliers or vendors for goods or services purchased on credit. It represents short-term liabilities.

- Accounts Receivable: The money owed to a company by its customers for goods or services sold on credit. It represents short-term assets.

- Break-even Point: The point at which your business’s total revenue equals its total expenses, resulting in zero profit or loss. It’s the minimum level of sales needed to cover all your start-up costs.

- Break-even Analysis: A financial analysis that determines the level of sales a company needs to cover all its costs and achieve a zero-profit point.

- Customer Lifetime Value (CLV): is the predicted net profit attributed to the entire future relationship with a customer. It helps determine the long-term value of acquiring and retaining customers.

- Churn Rate: is the rate at which customers discontinue their relationship with a company over a specific period. It measures customer attrition and helps assess customer retention efforts.

- Return on Assets (ROA): is a financial ratio that measures a company’s profitability relative to its total assets. It indicates how efficiently a company utilizes its assets to generate earnings.

- Return on Equity (ROE): is a financial ratio that measures the profitability of a company relative to its shareholders’ equity. It shows the return generated for each dollar invested by shareholders.

- Cash Conversion Cycle: The length of time it takes for a company to convert its investments in inventory and other resources back into cash through sales.

4.COSTS & ANALYSIS:

- Cost of Customer Acquisition (CAC): is the total cost incurred to acquire a new customer. It includes marketing and sales expenses, advertising costs, and other related expenditures.

- Fixed Costs: are costs that do not vary over a certain period of with the level of production or sales, such as rent, salaries, and insurance premiums.

- Variable Costs: are costs that change in proportion to the level of production or sales, such as raw materials, direct labor, and sales commissions.

- Burn Rate: The rate at which a company spends its available capital or cash reserves to cover operating expenses before generating positive cash flow. It helps assess the company’s sustainability and runway.

- Runway: The length of time a company’s available capital or cash reserves will last based on its burn rate. It indicates how long the company can operate before additional funding is required.

5. INVESTMENTS:

- Investment: is an asset purchased with the hope of generating income or increasing in value in the future. Examples of investments include stocks, bonds, and real estate.

- Stocks: are a share of ownership in a company. When you purchase stocks, you become a part owner of the company and can earn dividends or capital gains if the company does well.

- Bonds: are a fixed-income investment that pays interest to the investor over a specified period. Bonds are typically less risky than stocks and can be a good option for those seeking a stable, predictable return on their investment.

6. FUNDING & BUSINESS FINANCING:

- Dividend: A distribution of a portion of a company’s earnings to its shareholders as a return on their investment.

- Angel Investor: is an individual or group of individuals who provide early-stage funding to startups or small businesses in exchange for equity ownership.

- Venture Capital: are funds invested in startups or high-growth companies with significant growth potential. Venture capitalists provide capital in exchange for equity stakes.

7. BUSINESS & INVESTMENT EVALUATION:

- Initial Public Offering (IPO): The process by which a private company offers its shares to the public for the first time, in becoming a publicly traded company.

- Due Diligence: The process of conducting a thorough investigation or research to assess the viability, potential risks, and financial health of a company before making investment or acquisition decisions.

Intellectual Property Rights (IPR): Legal rights that protect intangible assets, including patents, trademarks, copyrights, and trade secrets.

8. TECH & ANALYTICS:

- Blockchain: A decentralized digital ledger technology that securely records and verifies transactions across multiple computers, providing transparency and immutability.

- KPI (Key Performance Indicator): Specific metrics used to measure and evaluate the success or progress of a company or project.

These are just a few basic business terminologies to get you started. As you explore deeper into the business and finance world, you’ll encounter more specialized terms that relate to your specific industry or niche. Remember to continually explore and expand your knowledge to stay abreast of industry-specific terms and emerging trends. There you have it friends, I hope these tips were helpful. To get started please see the resources below and if you would like to schedule a free 101 coaching call please feel free to do so I will be more than excited to help you build your online brand. Finally don’t forget to join the community and stay up-to date with all the exciting things that are happening. Thank you for listening, take good care of yourself.

Xo,

Ange

Ange Ingabire

SHOP MY OFFERS & RESOURCES FOR ASPIRING CREATIVE ENTREPRENEURS

1-1 COACHING

I help feminine creators build heart-centered businesses online from scratch without the overwhelm! Click the link below to find out more!

JOIN THE TRIBE

The Feminine Affluence Society is an all-encompassing community where creative faith meets digital commerce, it will provide you with a unique blend of business courses & resources, community support, faith building and business tools to help you thrive in the world of digital business as a solo Christian entrepreneurs.

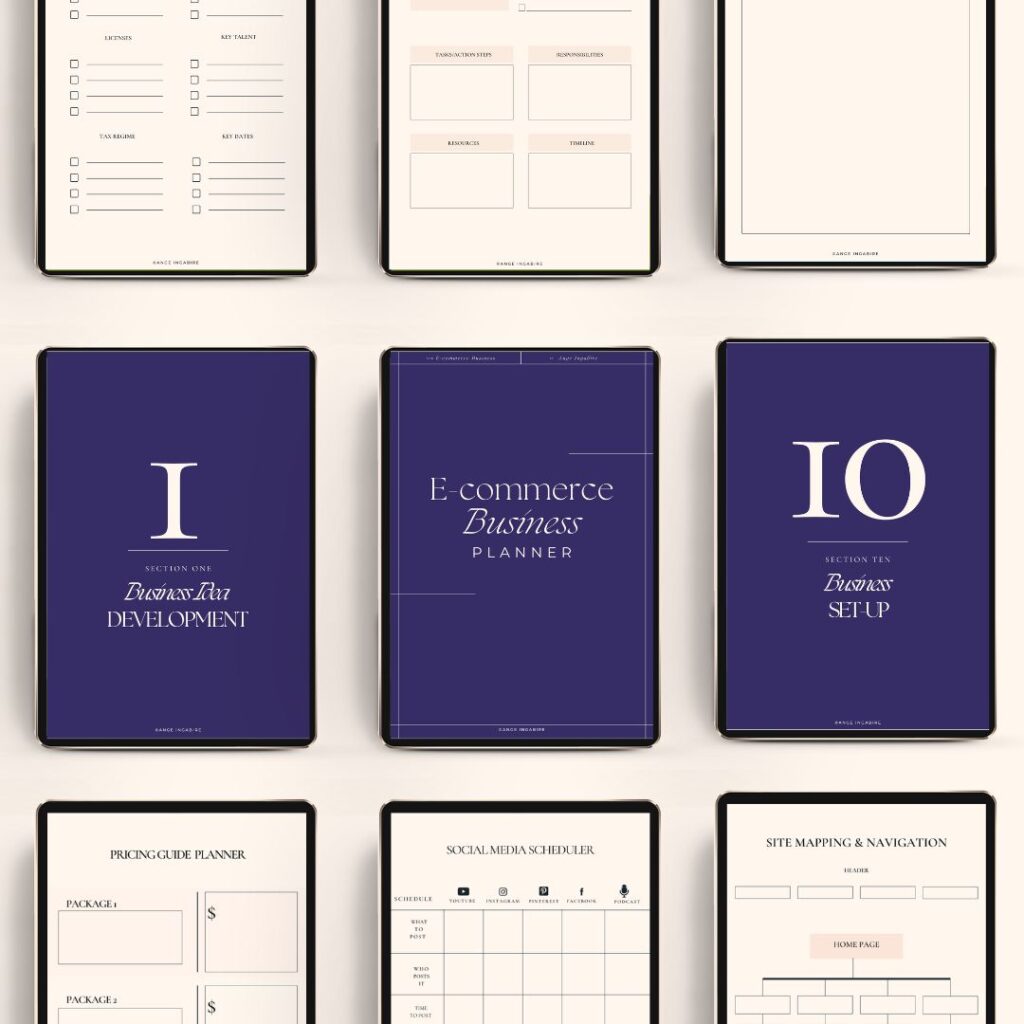

THE ULTIMATE E-COMMERCE BUSINESS PLANNER

This all-inclusive planner is a wealth of resources of 70+ expertly designed templates that will guide you through every step of your entrepreneurial journey.

THE IRRESISTIBLY & PROFITABLE OFFER KIT

One of the key factors in building a successful online brand is having a product or offer that sells. The Irresistibly Profitable Offer Kit equips you with the tools and resources to achieve maximum profitability and certainty about your product choice and creation.

THE CLIENT MAGNET & SALES MASTERY KIT

To thrive as an online brand, you need to master the art of sales. The Client Magnet & Sales Mastery Kit provides proven techniques, templates, and resources to boost your sales efforts.

THE BRAND BUILDING KIT

In a crowded digital marketplace, it’s crucial to create a brand that resonates with your dream customers. The Brand Building Kit empowers you to craft a unique and compelling brand.

THE DIGITAL MARKETING KIT

The Digital Marketing Kit equips you with the knowledge and tools to engage your dream customers effectively. Optimize your online presence, achieve your marketing goals, and gain the recognition and credibility your brand deserves.

THE E-COMMERCE WEBSITE BUILDER & LAUNCH KIT

Have everything you need to create a professional-looking website that is optimized for sales. You will get access to templates, design tips, and step-by-step instructions on how to launch your site.

THE BUSINESS LAUNCH SUCCESS KIT

Starting your journey as an entrepreneur requires careful planning and execution. The Business Launch Success Kit provides essential tools, training, and resources to turn your vision into a thriving reality.

THE CREATIVE STARTUP SUITE (FULL SET OF BIZ KITS)

A unique and systematic collection of tools and resources for the aspiring creative entrepreneur. It include video trainings, made for you guides, workbooks, scripts and editable templates that you can use to build your online brand from scratch and start making money in the next quarter!

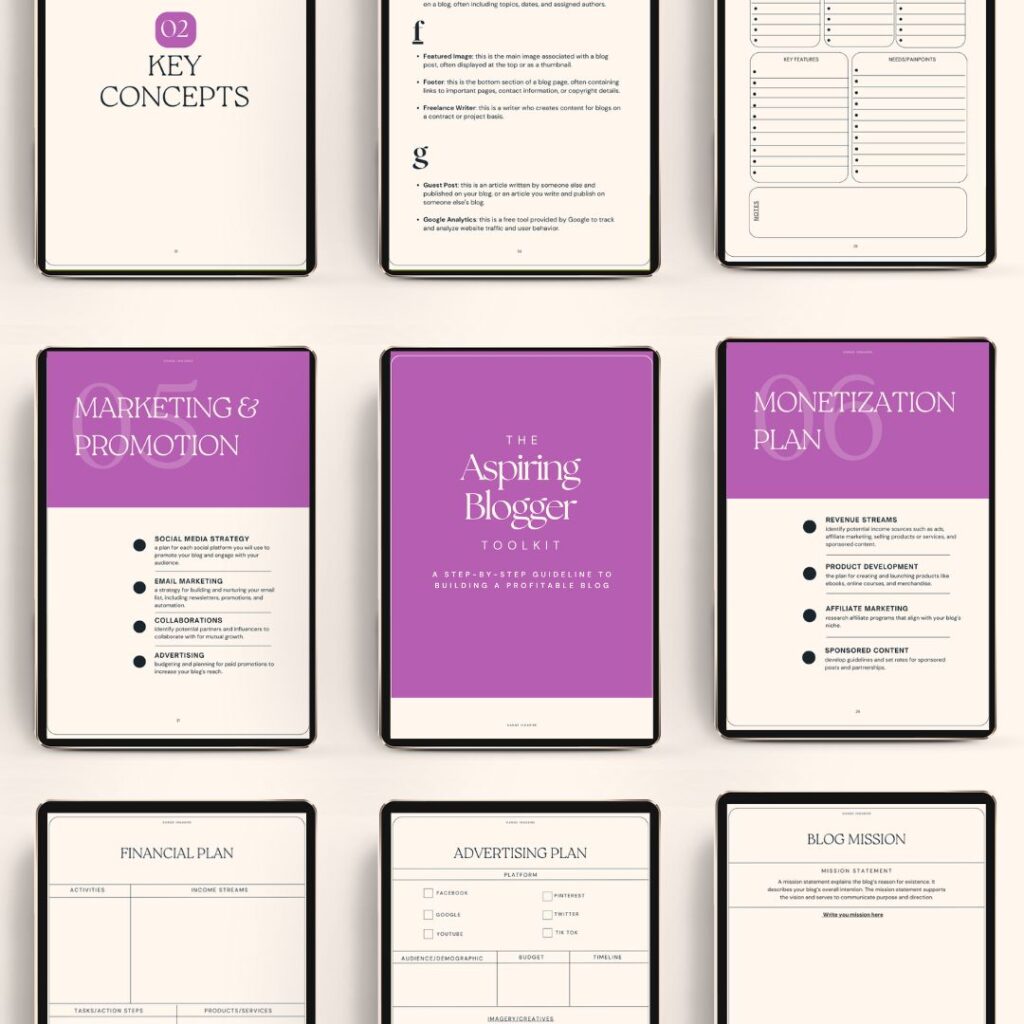

THE ASPIRING BLOGGER TOOLKIT

Blogging should be a joyful expression of your passions and expertise, not a source of stress. But the truth is, starting a blog can feel daunting, like where do you begin? This is where The Aspiring Blogger toolkit comes in! By providing you a clear roadmap for your next steps.

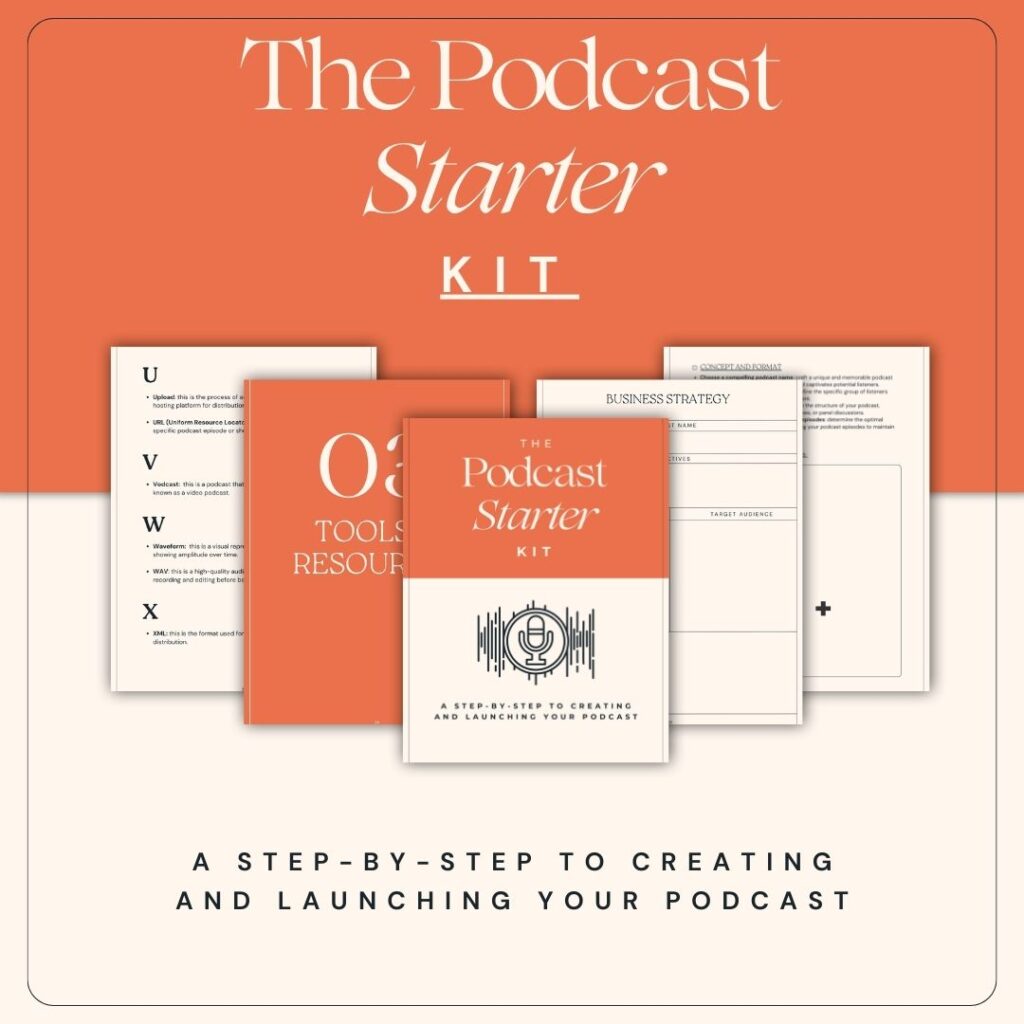

THE PODCAST STARTER KIT

Establish yourself as an authority in your niche with the Podcast Started Kit, I have assembled a comprehensive collection of resources to guide you through every step of your podcasting journey.

THE YOUTUBER LAUNCHPAD

From understanding the jargon to mastering the technical aspects, the initial steps to starting a YouTube Channel can feel daunting for a beginner. The Launchpad addresses these pain points directly, offering you a streamlined path to creating a professional and impactful YouTube presence.

THE CONTENT CREATOR POWERPACK

Your all-in-one solution to kickstart your content creation journey.

It is designed specifically for aspiring influencers and content creators, it is comprehensive bundle that provides you with everything you need to turn your passion into a thriving online presence; whether you want to start a blog, a podcast or youtube channel.

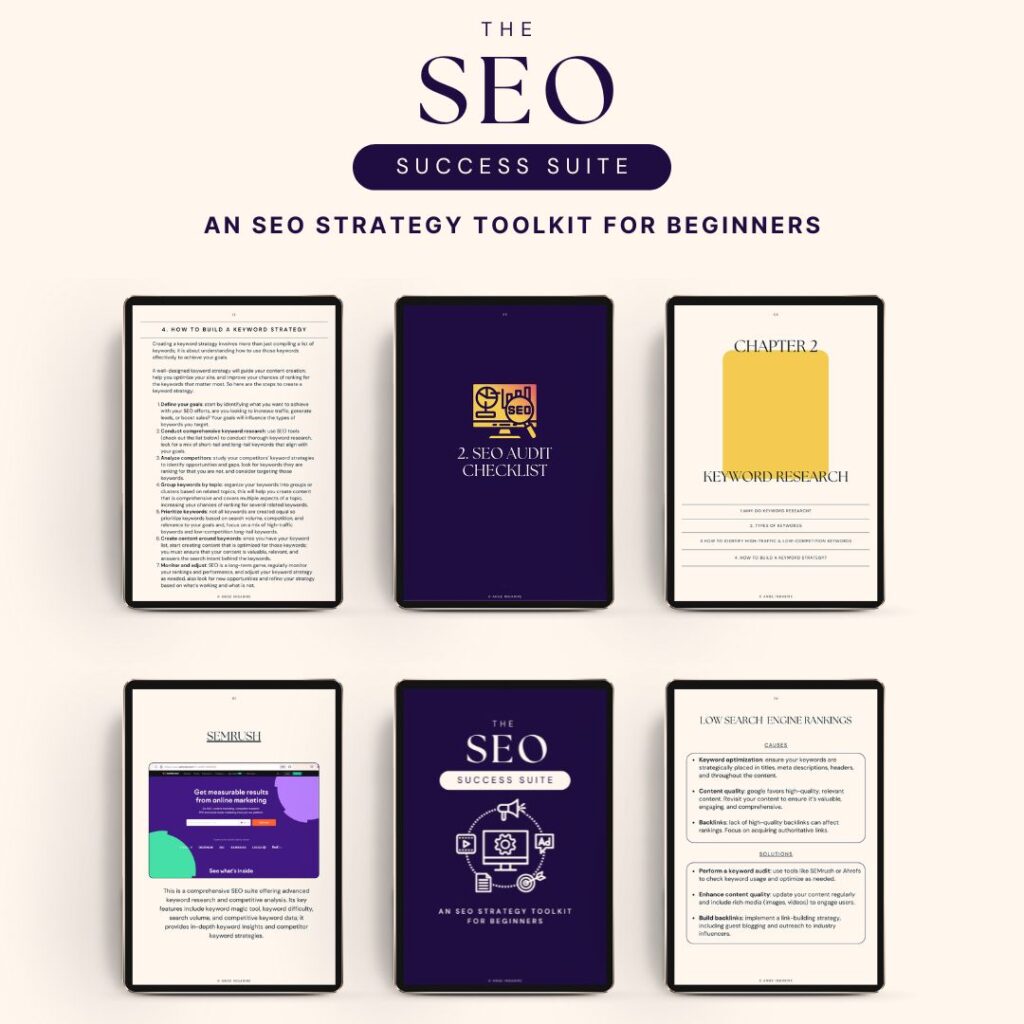

THE SEO SUCCESS SUITE

The SEO Success Suite is a practical toolkit designed to make SEO simpler, more manageable, and, yes, even enjoyable! I have designed the SEO success suite to take you from feeling stuck and frustrated to confident and in control of your online presence.